For local drivers, car owners, and businesses relying on towing services, understanding the cost of tow truck insurance is crucial. This type of insurance protects operators against potential liabilities and damages while also providing peace of mind. However, the premiums can vary widely based on numerous factors including truck size, location, and coverage types. In this article, we’ll delve into the specific factors influencing insurance costs, provide insights into average premiums, outline the types of coverage available, and present strategies for finding the best deals on tow truck insurance. By the end, you’ll have a thorough understanding of what shapes tow truck insurance pricing and how to make informed decisions.

Pricing the Guard: Understanding How Tow Truck Insurance Flows with Fleet Size, Risk, and Coverage

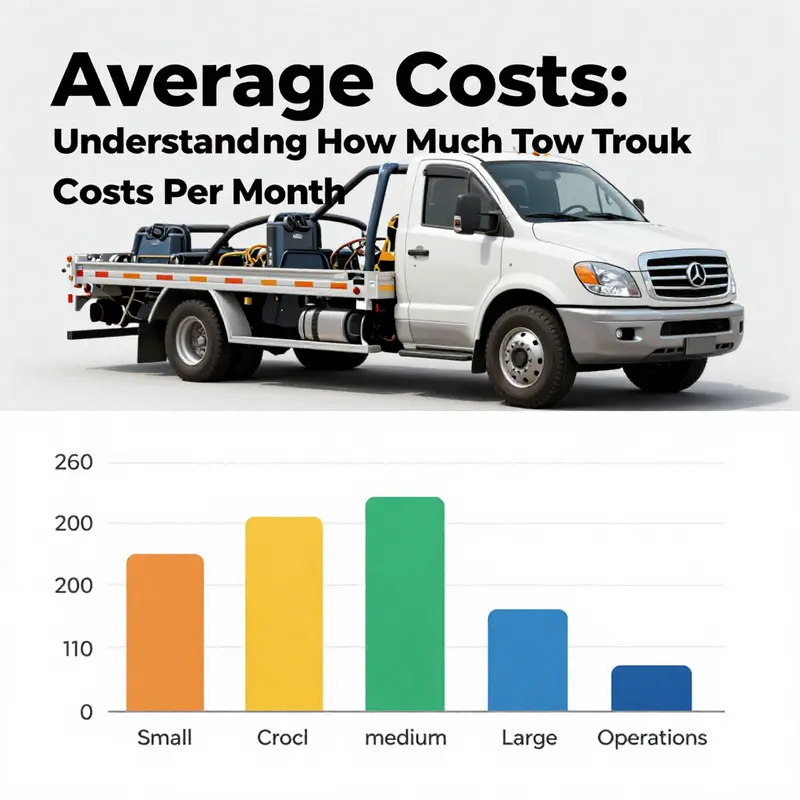

Tow truck operators carry a heavy responsibility, and that weight is reflected in the cost of protection. Insurance isn’t a single price tag you pay once a month; it is a moving target shaped by the vehicle, the people who operate it, where you work, and how you plan to run your business. When owners ask how much tow truck insurance costs per month, they’re really asking how much risk, in combination with the coverage chosen, they are willing to transfer to a carrier. The answer is nuanced, but it can be understood by looking at a few core factors that interact to set a monthly premium. The target range, on average, tends to hover in a broad band—from roughly two hundred dollars to five hundred dollars per month for many small to mid-sized operators. But that band shifts when any one of the major variables moves, whether up or down, and over time it shifts as a business grows, incidents accumulate, or locations change. The challenge—and the opportunity—lies in translating those factors into a predictable monthly cost that aligns with a company’s risk tolerance, cash flow, and service commitments to customers.

From the outset, the most visible determinant is the type and value of the tow truck itself. A compact, single‑unit rollback or light-duty wrecker will carry a different premium footprint than a heavy, multi‑unit operation with flatbeds, integrated winch systems, and specialized recovery equipment. The heavier the vehicle and the more specialized the equipment, the higher the potential exposure during a tow, a recovery, or an on‑scene operation. The insurer is weighing not just repair costs but the likelihood of a serious incident that could trigger liability or physical damage claims. As a result, premium calculations treat the premium as a function of both the hardware you own and the risk that hardware may be deployed in high‑stress environments. When the fleet includes multiple units, the cost structure becomes more complex, often leading to a tiered pricing arrangement where each additional unit adds its own incremental risk load. In practical terms, a small operator with one or two simple units in a low‑crime, low‑traffic area may see a cost nearer the lower end of the range. A larger operator with several trucks, mixed equipment, and urban routes may observe a middle or upper tier, depending on other factors.

Beyond the truck itself, the driver’s experience and driving record remain a central influence on monthly costs. Insurance is inherently a risk transfer mechanism, and underwriters place substantial emphasis on the operator’s track record. A clean driving history—few, if any, tickets or accidents—signals to the insurer that the likelihood of a first‑time claim is relatively low. Conversely, a history threaded with incidents or violations signals higher probability of future claims, and that history shows up in the monthly premium. The relationship between driver experience and premium can be particularly pronounced for tow operators who frequently work at night, on busy highways, or in poor weather. In those contexts, even a single accident or a pattern of near misses can push rates upward, sometimes sharply, as underwriters reassess overall risk exposure. The recalibration often occurs not only with the insured vehicle but also with any additional drivers who might be authorized to operate it.

Geography matters as much as any other individual factor. The monthly premium reflects the cost of doing business in a given locale. Urban centers with dense traffic, higher theft rates, and more frequent collisions generally attract higher premiums than rural customers. These differences are not merely about distance from a carrier’s home office; they reflect actual risk profiles in the operating area. For example, a tow operator in a congested metro district may pay more because the odds of a tow accident, a roadside injury, or a cargo loss increase in a setting where crowds, commuters, and commercial traffic intersect. In contrast, operators serving calmer rural corridors may face lower premiums due to reduced exposure. The model thus rewards operators who can demonstrate safer routes, better timeslots, and disciplined on‑scene procedures that minimize risk.

The level of coverage selected is the most obvious lever operators can pull to change the monthly bill. Liability protection is the foundational layer that covers damage or injuries to others when the tow truck is at fault in an incident. Physical damage coverage insures the vehicle itself in the event of collision, theft, or other damage. Tow liability, cargo coverage, and uninsured/underinsured motorist protection add further cushions for business interruptions, customer goods, and drivers who face medical costs or wage losses after an event. The more you insure—whether through higher liability limits, comprehensive physical damage protection, or cargo recall—the more you should expect to pay each month. Yet, the cost is rarely proportional. Many insurers design pricing to balance the level of protection with incentives for safer operations, certain safety measures, and fewer claims. In other words, you can sometimes achieve meaningful cost reductions by adopting smarter coverage limits that align with realistic risk exposure and by layering in protections that specifically address the most common claim types for tow operators.

Underwriting practices operate behind the scenes to translate risk into premium. Every insurer applies a unique set of rules and models when evaluating a policy. One company might place more emphasis on fleet size and utilization patterns, while another may focus on the operator’s experience and claims history. Two operators with nearly identical equipment, routes, and safety programs can receive noticeably different quotes because of how an underwriter interprets risk signals or how they weight certain data points. This is not random; it reflects a deliberate risk management philosophy. A carrier’s appetite for certain risk profiles evolves with market conditions, claims experience, and the availability of predictive tools such as telematics data and driver training histories. The net effect is that even small differences in underwriting approaches translate into real differences in your monthly costs.

A business’s claims history serves as a forward‑looking barometer for ongoing cost. Past claims create a durable imprint on the premium you pay. A clean history—especially in the first few years of operation—can produce favorable pricing, while a string of claims can push rates up and keep them elevated until the risk profile shifts again. The impact of claims history can be compounded if the business is still relatively small, because insurers may view new companies as higher risk simply due to lack of long‑term track records. This is not to say a single accident will doom an operation’s affordability, but it does mean that risk mitigation, proactive claims management, and transparent reporting become crucial strategies for maintaining stable costs over time.

All of these factors intersect with practical actions a tow business can take to influence monthly premiums. For instance, adopting a formal safety program can reduce the cost of coverage by aligning with insurers’ expectations of lower risk. Training that leads to certified operator status or recognized safety competencies can unlock discounts and create a stronger long‑term cost trajectory. Likewise, implementing fleet standardization and emergency readiness practices helps manage risk by ensuring standard procedures across all units, which reduces the chances of on‑scene errors and claims. To explore these concepts in a structured, fleet‑wide way, many operators turn to guides and resources that emphasize standardization and preparedness, underscoring how a disciplined approach to operations can have a measurable impact on insurance affordability. For a practical look at how standardization and readiness feed into risk management for tow operations, you can explore resources like the fleet standardization and emergency readiness guide.

Beyond these internal controls, a critical step for anyone evaluating monthly insurance costs is to solicit multiple quotes and calibrate expectations across a spectrum of coverage options. It is essential to remember that the cheapest policy is not always the best fit for a tow operation. A policy with very low liability limits or limited physical damage coverage might save money in the short term but expose the business to large, uncompensated losses if an accident occurs or a cargo claim arises. Conversely, a policy with higher limits and broader protections can provide more robust protection and potentially greater peace of mind, especially for operators serving high‑risk environments or handling sensitive loads. The right balance often comes down to a careful assessment of exposure, customer requirements, and the financial ability to absorb small or moderate losses without destabilizing the business.

Given the range of influences, a practical approach to budgeting for tow truck insurance is to start with a baseline that mirrors the common experience of peers: a single, well‑maintained unit in a low‑risk area tends to fall near the lower end of the spectrum, while a sizeable operation with fleets, diverse equipment, and urban routes tends to occupy the middle to upper portion. Then, layer in the specific protections your business requires. If you operate in a high‑theft zone or routinely service costly cargo, higher coverage makes sense. If your routes are predictable and your drivers are well trained, you may find you can negotiate more favorable terms over time as you demonstrate consistent safety performance. In practice, this means documenting your risk controls, maintaining up‑to‑date maintenance records for vehicles, and keeping clear records of driver training and incident prevention. When these elements are in place, insurers can quantify the reduced risk more precisely, and you may see the cost price drift toward the lower end of your expected range.

To connect these ideas to a concrete budgeting mindset, consider how you structure a monthly payment plan. Some operators choose to pay annually for a bit of a discount, while others prefer monthly billing to align with cash flow cycles. In either case, the emphasis remains on aligning coverage with actual risk exposure rather than chasing the lowest price. If you are building or revising a policy framework, seek out a trusted insurer with experience in commercial auto and tow operations. While it is possible to obtain quotes from national carriers, it is often the specialist in commercial auto insurance who understands the nuances of tow work—the on‑scene realities, the cargo considerations, and the unique liability concerns involved in roadside service. A tailored policy can address not only liability, physical damage, and cargo concerns, but also issues like on‑site safety protocols, driver qualification standards, and incident reporting procedures that ultimately shape both risk and cost.

The practical takeaway is that monthly tow truck insurance is not a fixed line item; it is a dynamic reflection of your fleet, your people, and your process. If you want to bring the monthly cost down within a fair and sustainable range, focus on how you manage risk as a business—standardize operations across your fleet, invest in driver safety, and maintain rigorous maintenance and incident reporting. These steps don’t just improve safety; they improve the overall risk profile that underwriters evaluate when they price coverage. And when your risk profile becomes clearer and more favorable over time, you should see the monthly numbers respond in kind. For operators pursuing a deeper practical framework on standardization and emergency readiness, you can reference a guide that emphasizes how these practices translate into real‑world risk reduction. fleet standardization and emergency readiness guide.

In closing, the monthly cost of tow truck insurance is the price of a defined balance: the level of protection you need, the real risks you face, and the discipline of your operations. By understanding how each factor—vehicle type, driver history, geography, coverage mix, underwriting approach, and claims history—contributes to pricing, you can make smarter decisions about coverage, pricing, and risk management. And as your business evolves—from one unit on quiet streets to a growing fleet in more challenging settings—the framework you use to assess and manage risk will shape not only your insurance bills but also your ability to serve clients reliably, respond to emergencies efficiently, and sustain profitability over the long haul. For a detailed external perspective on how insurers price tow truck policies and what to expect when shopping for coverage, see The Hartford’s comprehensive guide on tow truck insurance. https://www.thehartford.com/insurance/small-business/tow-truck-insurance

null

null

The Layered Equation of Tow Truck Insurance

Tow truck insurance pricing blends risk and protection into a monthly figure. The core of the package is commercial auto liability, with premium influenced by vehicle type, usage, routes, and claims history. Physical damage coverage covers the truck and any recovery gear. Non owned auto liability protects against work related use of personal vehicles. Cargo and equipment coverage guards tools and gear. General liability and workers compensation add protection for site injuries and employee costs. The exact mix depends on fleet size, operations, location, and safety programs, so prices can range from a few hundred to several thousand dollars per month. For budgeting, compare quotes across insurers, verify coverage limits, deductibles, and exclusions, and consider discounts for training and safety features. A well structured policy should shield the business from the financial impact of serious incidents while remaining affordable for ongoing operations.

Decoding the Monthly Cost of Tow Truck Insurance: How to Find the Best Deals Without Sacrificing Coverage

Tow truck operators often confront a straightforward question with a surprisingly wide range of answers: how much is tow truck insurance per month? The reality hinges on a web of interacting factors, including where the business operates, the type and size of the fleets, the driver profile, and the exact mix of coverage chosen. What remains constant is the core idea that insurance is a business expense that protects both personnel and equipment, and that the monthly premium can be a meaningful line item on the ledger. In practical terms, most operators will find monthly premiums that sit somewhere in a broad band, with small, single-vehicle outfits in low‑risk locales tipping toward the lower end and larger fleets with heavy equipment and higher exposure pushing toward the upper end. Across the industry, you’ll frequently see ballpark ranges that help frame planning: a few hundred dollars per month for simple, light‑duty towing in calm markets, versus several hundred dollars for more complex fleets operating in denser urban areas with more demanding equipment and service profiles. Yet those ranges are only a starting point, not a final answer. When you factor in the vehicle type, the business structure, and the precise coverage mix, the price you see in a quote can shift markedly. A small, one‑truck operation in a relatively quiet region might hover around two to three hundred dollars monthly, while a mid‑to‑large operation with multiple units, specialty rigs, or a broader service area can push toward four hundred, five hundred, or more per month. It’s not simply about the number of trucks; it’s about the risks you carry, the protection you want, and the way the policy is structured to fit the realities of your day‑to‑day work. In practice, the most economical path often comes from understanding how different policy elements work together to create comprehensive protection that aligns with the budget you can sustain month after month. A foundational insight is that price is not the sole determinant of value. A policy that appears cheaper at first glance may leave gaps that become costly when a claim arises. Conversely, a more expensive monthly premium that includes extensive coverage and convenient service options can reduce overall risk exposure and preserve cash flow during a loss event, making the premium a prudent investment rather than a sunk cost. This is especially true for operators who rely on dependable roadside assistance as part of the standard auto policy. In many cases, the inclusion of towing support, jump starts, changes to flat tires, or fuel delivery as part of a broad auto coverage can be more economical than maintaining a separate, stand‑alone towing policy. The practical takeaway is to treat coverage as a system rather than a collection of isolated line items. A comprehensive approach that covers liability, physical damage, towing liability, cargo, and the ancillary services that keep a fleet moving can yield better protection at a reasonable monthly cost, particularly when discounts are available and claims histories are favorable. To translate these ideas into a pricing reality, it helps to understand the major drivers that steer monthly costs. First, location matters. Urban centers, high‑traffic corridors, or regions with elevated risk of theft, theft attempts, or vandalism can push premiums higher. Conversely, rural or lower‑risk geographies often offer competitive pricing, even for fleets with multiple units. The nature of the vehicles matters as well. A compact, light tow unit with standard equipment has different risk characteristics than a heavy‑duty wrecker with extended reach and specialized gear. The more specialized the equipment, the more exposure the insurer must underwrite, which tends to raise the cost. Second, the scope of coverage matters. A policy with broad liability limits, physical damage protection for each unit, towing liability, and cargo coverage will naturally carry a higher price than a leaner plan that limits coverage to core liability. Yet those additions are precisely what prevent a single incident from turning into a financial catastrophe. If a fleet is exposed to high miles, frequent towing in challenging conditions, or the risk of cargo loss, it is often worth investing in higher coverage limits and more robust add‑ons. Another critical factor is the operator’s safety and compliance profile. Programs that reward safe driving, ongoing safety training, and formalized emergency readiness can unlock premium discounts. Insurers want to see that operators are proactive about risk management; the presence of documented safety programs, regular maintenance schedules, and driver certification can translate into measurable savings over time. A clean claims history also pays dividends. A history of fewer, lower‑severity claims signals to underwriters that risk is managed well, which can translate into lower premiums or more favorable terms. Conversely, a claim‑heavy profile can raise the price or constrain coverage options. The business structure itself plays a role as well. A sole proprietorship may be treated differently than an LLC or a corporation in pricing, governance, and risk allocation. Fleet size is another obvious lever: more trucks and more drivers generally equate to higher exposure and higher premiums, but economies of scale can sometimes apply if an insurer can offer a bundled package that covers all units under one policy with uniform terms. The mix of coverage types is where many operators spend time making deliberate choices. A baseline policy typically includes liability insurance, which covers damages to others if the operator is at fault. Beyond that, many fleets add physical damage to protect their own trucks from collision, fire, vandalism, and other perils. Towing liability covers the work performed during towing operations, including the risk that a tow causes damage to a vehicle or injury to a bystander. Cargo insurance, depending on the nature of the loads, can protect against loss or damage to customers’ goods. Finally, some operators consider add‑ons such as on‑hook coverage for equipment, rental reimbursement, or travel reimbursement to keep the business rolling after an incident. Each of these components adds to the monthly cost, but they also reduce the out‑of‑pocket exposure during an accident or service interruption. The pricing reality is that the best approach to securing a favorable monthly rate is to engage in a disciplined shopping process that weighs both price and protection. Begin by collecting quotes from reputable commercial auto insurers who understand the towing sector. It’s not enough to request a single price; you want apples‑to‑apples comparisons that reflect identical coverage levels, deductibles, and scopes of operations so you can determine the true value of each option. While you compare, look for policies that include roadside assistance as a standard feature. In many cases, this can be a meaningful saving, either by reducing the need for separate towing coverage or by consolidating services under one umbrella. If you are contemplating a standalone towing plan, examine what level of service is included and how it compares to what your auto policy already provides. In some situations, operators discover that the incremental cost of a dedicated towing plan is justified, while in others the existing policy with built‑in roadside assistance delivers the same outcome at a lower monthly outlay. Either way, the goal is to frame the choice around total risk management rather than only the monthly premium. If you’re exploring dedicated towing service options, you’ll see the most consistent patterns in how coverage levels translate to monthly costs. Basic plans for subscription roadside assistance commonly fall in the range of ten to thirty dollars per month. These plans typically cover routine towing within short distances and standard roadside tasks such as jump starts or tire changes. Premium plans, which can include longer towing distances, 24/7 support, travel reimbursement, and even rental car coverage, often sit between thirty‑five and sixty dollars per month. These figures provide a useful context when weighing the value of an add‑on versus a bundled auto policy with roadside benefits. For practical decision making, it helps to walk through a scenario. Suppose a small two‑truck operation in a moderate market is evaluating a bundled policy that includes liability, physical damage, and roadside assistance with standard limits. The monthly cost might land in the lower to mid hundreds, reflecting a balance between protection and affordability. If the same operation expands to a fleet of five or more units, the insurer will reassess the exposure and pricing, and the operator may find room to negotiate multi‑unit discounts or a flexible payment arrangement. In coastal or metropolitan zones with higher incident rates, the per‑truck rate will typically rise, but the incremental cost per additional truck may be offset by volume discounts if the policy is structured as a fleet program rather than multiple standalone policies. The process of securing the right price therefore becomes a negotiation of value. You want coverage that is aligned with the real risks faced by your fleet, not a one‑size‑fits‑all package sold as a bargain. A careful comparison should also consider the broader risk management strategy of the business. Do you have a formal driver training regimen, regular vehicle maintenance checks, and a documented emergency readiness plan? If so, these elements can contribute to a stronger underwriting case and potentially more favorable terms. If not, it may be worth investing in those programs first, not only to qualify for discounts but also to reduce the likelihood and impact of claims. In addition, be mindful of how coverage interacts with other protections you may carry. Some operators already تحمل a form of cargo protection as part of their general commercial auto plan, and adding a standalone cargo policy may be unnecessary duplication. The ultimate objective is clear: secure a policy that covers the unique risks of tow operations while keeping the monthly premium within a budget that supports sustained service quality and profitability. To help you further refine your path, consider exploring resources that discuss practical approaches to operations readiness and fleet standardization, as these discussions often illuminate why certain insurance choices make more sense for towing businesses. For example, a practical overview of standardization and emergency readiness in heavy duty rescue operations can provide useful context for risk management and insurance planning. If you want to see how these ideas translate into real‑world practice, you can visit a specialized resource that focuses on tow operations and fleet resilience at the following link: santamariatowtruck.com/blog/. This reference can offer perspective on how operators structure their services, plan for emergencies, and align operational practices with insurance considerations. When you prepare to request quotes, you should also assemble a clear picture of your fleet, service patterns, and coverage needs. Documents such as vehicle VINs, current mileage, typical load weights, maintenance schedules, and details about drivers’ licenses and driving histories will streamline the underwriting process. Having a well‑organized packet signals to underwriters that you are a reliable risk and can facilitate quicker, more favorable pricing. It is also wise to solicit quotes that present a single, coherent policy with consistent terms across all units. Even if you negotiate separately for liability, physical damage, and cargo in some cases, the more integrated the policy, the less friction you will encounter if you need to file a claim or make a mid‑term modification. In short, the monthly cost of tow truck insurance is not a fixed number but a function of risk, protection, and business discipline. The most economical, sustainable approach is to design a coverage framework that mirrors the realities of your operation, leverages bundled services where appropriate, and uses safety and readiness as levers for lower premiums. While the exact price will vary, the emphasis should be on building a protection package that reduces the odds of out‑of‑pocket losses and, in the event of an incident, keeps your fleet on the road with minimal disruption. For operators who want a practical starting point, engage with reputable commercial auto insurers to compare quotes that reflect the scope of your operation. Prepare to discuss not only the price per month but also the degree of protection, the reliability of service, and the speed with which claims are processed. In doing so, you’ll be better positioned to select a monthly premium that aligns with your business goals and your tolerance for risk. External references can help you calibrate expectations and provide a broader view of how insurers assess towing risk, the typical range of monthly costs, and the kinds of add‑ons that most fleets find valuable. External reference: https://www.progressive.com/commercial/

Final thoughts

Tow truck insurance is a vital component for any towing business, ensuring that operations run smoothly and without financial risk. As highlighted throughout this article, the cost of this insurance varies significantly based on several factors including your operation type and coverage requirements. Understanding these elements enables you to make informed decisions that can lead to significant savings. As you seek out insurance options, remember to compare rates, assess coverage types, and consider the experience of your operators for potential discounts. The right insurance not only protects your business but also enhances your service’s reliability in the community.