The regulation and tariff landscape for heavy-duty trucks is a complex and evolving issue that has significant implications for manufacturers, consumers, and the economy at large. President Trump’s announcement of a 25% tariff on all imported heavy-duty trucks marks a critical juncture in this landscape. This bold move, aimed at nurturing U.S.-based manufacturing, promises to not only reshape the competitive dynamics within the trucking industry but also ripple through the broader economy.

With major stakeholders like Peterbilt, Kenworth, and Freightliner potentially facing changing market scenarios, the stakes are high. As truck manufacturers and operators contemplate the costs and benefits of this tariff, its long-term effects on truck prices, availability, and operational costs will likely reverberate beyond the industry confines.

This article delves into the significance of these regulations and tariffs, exploring their far-reaching consequences and what they mean for the future of heavy-duty trucking.

Historical Context of Truck Tariffs

The history of tariffs on trucks in the United States provides a significant backdrop to the current regulatory landscape. One pivotal moment came in 1964 with the implementation of the “Chicken Tax.” This 25% tariff was levied on light trucks as retaliation for European tariffs on American poultry. The Chicken Tax had a lasting effect on the automotive industry, allowing American manufacturers like Ford, General Motors, and Chrysler to secure a dominant position in the light truck segment. The tariff led foreign manufacturers, such as Toyota and Nissan, to establish production facilities within the U.S. to bypass the trade barrier. This shift not only stimulated local economies but also reshaped global supply chains and manufacturing strategies, emphasizing the importance of domestic production.

Fast forward to recent history, under President Donald Trump, new tariffs were imposed in October 2025, including a significant 25% tariff on all imported medium- and heavy-duty trucks and associated parts, reflecting national security concerns. This move aimed at bolstering U.S.-based manufacturing but raised immediate concerns regarding potential price hikes for consumers and manufacturers alike. A study indicated that these tariffs could cost U.S. automakers over $108 billion, with the major players in the domestic market facing significant increases in production costs due to tariffs on imported parts.

The impact of these tariffs has been multifaceted:

- Increased Costs: Tariffs on imported vehicles and parts raise production costs for manufacturers, leading to potentially higher prices for consumers.

- Supply Chain Realignment: To manage costs, manufacturers are incentivized to source parts domestically or from tariff-exempt countries, altering the supply chain dynamics.

- Investment in Domestic Facilities: Both domestic and international companies have invested heavily in U.S. facilities to mitigate the effects of tariffs.

- Market Dynamics Shift: While tariffs may benefit domestic manufacturers in the short run, they often result in elevated vehicle prices for consumers, which can affect overall demand in the market.

These historical instances of tariffs underscore the delicate balance between protecting domestic industries and ensuring competitive pricing for consumers, a challenge that continues to evolve with changing regulations.

| Manufacturer | Market Share (%) | Headquarters | Recent Initiatives |

|---|---|---|---|

| Peterbilt | 19.2 | Denton, Texas | Expansion of electric truck models |

| Kenworth | 17.5 | Kirkland, Washington | Launch of advanced safety features |

| Freightliner | 24.3 | Portland, Oregon | Investment in eco-friendly technologies |

| Mack Trucks | 11.7 | Greensboro, North Carolina | New hybrid truck models |

| International Motors | 12.4 | Lisle, Illinois | Initiative for autonomous driving tech |

| Volvo | 7.5 | Greensboro, North Carolina | Enhanced connectivity features |

| Wabash | 3.3 | Lafayette, Indiana | Development of lightweight materials |

| Fleetco | 1.1 | Various Locations | Fleet modernization programs |

| CS Truck and Trailer | 1.2 | Various Locations | Focus on customer service enhancements |

| RK Logistics | 1.0 | Tempe, Arizona | New logistics facilities opening |

Analysis of Economic Implications of the 25% Tariff on Heavy-Duty Trucks

The recent imposition of a 25% tariff on imported heavy-duty trucks is set to have profound economic implications. This analysis delves into how the tariff impacts manufacturers, suppliers, and consumers, touching on key themes such as pricing, competition, and job creation.

Pricing Impact

The tariff is expected to lead to significant price increases for heavy-duty trucks. According to the American Trucking Associations (ATA), the cost of a new Class 8 truck could rise by approximately $30,000 due to the new tariff. Such an increase compounds existing trends; from 2021 to 2023, the average price of Class 8 tractors surged from about $140,000 to $170,000, reflecting a rise of approximately 21%. Furthermore, estimates from S&P Global Mobility suggest that the net effect on truck prices might reach around 9%, which could significantly reduce demand for new commercial vehicles by as much as 17%.

These price hikes not only affect truck manufacturers but also ripple through industries reliant on such trucks, potentially increasing operational costs and limiting accessibility for smaller businesses that depend on these vehicles. In light of these factors, it is crucial to observe heavy-duty truck market trends and how they can inform stakeholders about potential fluctuations in the costs of these vehicles.

Competition Changes

The competitive landscape in the heavy-duty truck sector is poised for transformation. U.S.-based manufacturers such as Paccar Inc. may gain a competitive advantage over foreign companies due to the tariff. Following the announcement, stocks for Paccar rose nearly 7%, signaling investor confidence in the company’s enhanced market position. Conversely, companies like Daimler Truck and Traton, which operate extensively outside the U.S., have already started to see declines in their shares, indicating potential difficulties in maintaining their market presence against U.S. competitors. Monitoring the heavy-duty truck market trends will be vital for analyzing how these shifts will continue to affect competition.

Supplier Concerns

The tariff also affects suppliers who may have to adjust their sourcing strategies to remain competitive. The added costs associated with importing parts and vehicles could drive manufacturers to prioritize domestic suppliers or those from countries exempt from tariffs, fundamentally altering existing supply chain dynamics. The evolution of the heavy-duty truck market trends could lead to suppliers re-evaluating partnerships to navigate these challenges effectively.

Job Creation and Labor Market Implications

Proponents of the tariff argue that it could stimulate domestic manufacturing and job creation by making imported trucks more expensive, thereby encouraging increased production within the U.S. This growth could bolster jobs in the automotive sector. However, critics caution against overestimating job growth, warning that higher costs could dampen consumer demand and affect employment in sectors reliant on heavy-duty trucks.

The American Trucking Associations has expressed concerns that the additional expenses — upwards of $35,000 for a new heavy truck — may lead businesses to delay fleet renewals, potentially stunting job growth in logistics and maintenance sectors dependent on service demand.

Conclusion

The economic implications of the 25% tariff on heavy-duty trucks represent a complex interplay among rising prices, evolving competition, and labor market uncertainties. As stakeholders adjust to these changes, the long-term effects on the industry and the broader economy will unfold, shaping the future of heavy-duty trucking in profound ways.

User Adoption Data of Heavy-Duty Trucks in the U.S.

The landscape of heavy-duty truck adoption in the United States showcases a complex interaction of market dynamics in 2025. Despite a significant peak in sales during June 2025, where Class 8 trucks surpassed 20,000 units—marking a 12.5% increase compared to the same month in 2024—the overall sales for the first half of 2025 reflect a 5% decline year-over-year. This downturn is echoed in medium-duty truck sales, which dropped 6.7% during the same timeline. Overall, commercial truck sales reached 217,936 units, indicating a 5.9% decrease from the previous year [nada.org].

Further compounding these challenges is the sobering statistic that Class 8 truck orders fell to a 16-year low, totaling just 9,400 units in June 2025. This staggering 36% drop year-over-year can be attributed to factors such as high inventory levels, low profit margins for fleets, and market uncertainties that stem from recent tariffs [nada.org].

In terms of market value, the U.S. heavy-duty truck sector was valued at approximately $51.56 billion in 2025 but is projected to grow to $71.81 billion by 2030, presenting a compound annual growth rate (CAGR) of 6.85% largely driven by federal infrastructure investments and increasing electrification of vehicles [mordorintelligence.com]. However, Volvo Group has signaled continued weakness in the North American truck market, revising its 2025 delivery estimates downward, expecting only 265,000 units due to an anticipated sustained slump in freight activity alongside the tariffs that were introduced [reuters.com].

Consumer preferences are also shifting, influenced by the rise of e-commerce and last-mile delivery demands. The trend sees a greater emphasis on light-duty trucks and vans, particularly those designed for efficient urban maneuvers. Interestingly, approximately 25% of consumers now prefer to shop online, which has subsequently increased demand for specialized trucks that can meet these last-mile specifications [psmarketresearch.com].

Moreover, the adoption of electric vehicles is poised to reshape the heavy-duty truck market significantly, with over 66,000 electric trucks sold in the U.S. by 2023. This movement is bolstered by government incentives and new emission regulations that drive manufacturers toward electrification [kenresearch.com].

In summary, while there is the potential for growth in the heavy-duty truck market, current adoption rates are influenced by multiple factors, including high inventory levels, recent tariff implications, and shifting consumer preferences towards electric and light-duty vehicles. Current economic conditions reflect a challenging environment for stakeholders, necessitating adaptations in strategy and offerings to align with evolving market demands and regulatory contexts.

Industry Leaders Respond to Tariffs on Heavy-Duty Trucks

The imposition of a 25% tariff on imported heavy-duty trucks has sparked significant concern among industry leaders and stakeholders about its effects on operational costs and the overall market landscape.

Chris Spear, President & CEO of the American Trucking Associations (ATA), expressed worry about the potential negative impacts of these tariffs:

“As the trucking industry recovers from a lengthy freight recession characterized by low freight volumes and rising operational costs, we are concerned that tariffs could decrease freight volumes and lead to higher costs for motor carriers during this recovery phase.”

This feedback highlights apprehensions that rising costs could hinder the industry’s growth.

Spear further cautioned that these tariffs might lead to unintentional effects on the economy:

“While we strive to enhance our communities, we must prevent unintended consequences that could worsen another major concern for Americans: high prices for goods and groceries.”

Derek Leathers, CEO of Werner Enterprises, voiced similar concerns, particularly regarding the financial strain on trucking companies:

“We simply cannot absorb additional costs for trucks right now.”

His statement reflects a common sentiment among fleet operators who are anxious about increasing expenses.

A representative from Paccar Inc. pointed out that U.S. truck manufacturers face competitive challenges:

“American-made heavy-duty trucks are already burdened with a cost disadvantage of $10,000 or more per truck compared to those assembled in Mexico.”

This emphasizes how tariffs can impact pricing and make products less accessible to consumers.

The Volvo Group highlighted broader implications for the entire supply chain:

“Since our industry relies on a global supply chain, new tariffs on truck parts would significantly raise costs for manufacturers, dealers, and ultimately, for trucking customers both in the U.S. and export markets.”

This illustrates how interconnected the industry is and how tariffs can affect costs at multiple levels.

Stephen Laskowski, President & CEO of the Canadian Trucking Alliance (CTA), warned of severe consequences due to the current economic climate:

“The 25% tariffs could result in significant job losses and permanent fleet closures.”

His remarks resonate with many in the industry concerned about the potential fallout.

The U.S. Chamber of Commerce emphasized the current struggles within the trucking sector:

“The trucking industry is facing record-high operating costs, with expenses reaching $2.270 per mile in 2023—a historic high.”

This points to a pressing issue: increasing costs might deter companies from investing in new equipment, leading to older trucks remaining in service longer, and increasing maintenance expenses.

These insights reflect an industry grappling with the challenges posed by tariffs and regulatory changes. Stakeholders across the sector are worried that compliance costs and higher prices for consumers could hinder growth, lead to job losses, and significantly impact the supply chain.

Conclusion

The introduction of a 25% tariff on imported heavy-duty trucks by President Trump establishes a watershed moment in the U.S. trucking industry that carries considerable long-term implications. As outlined in this article, this policy is positioned to affect prices dramatically, with estimates suggesting increases of approximately $30,000 per new Class 8 truck. This shift not only poses challenges for consumers and manufacturers alike but also has the potential to alter supply chains and market competitiveness in unforeseen ways.

Manufacturers may see a temporary boost in domestic production, however, rising costs could also stifle overall demand as businesses reevaluate fleet renewals amidst economic uncertainties. The comments from industry leaders underscore a broader apprehension: elevated prices may escalate operational costs for motor carriers, hindering an industry that has only just begun to emerge from a prolonged period of stagnation. Furthermore, critics assert that the implications might extend beyond mere economics, permeating into job markets and economic stability across sectors that rely on heavy-duty transportation.

Looking ahead, it will be crucial for stakeholders—ranging from manufacturers to policymakers—to monitor how these tariffs may intersect with future regulations and market evolutions. As the trucking industry navigates these complexities, readers are encouraged to maintain a critical perspective on the unfolding effects of these tariffs on the broader U.S. economy. Engaging with this issue will help inform decisions and strategies that support healthy competition and sustainable growth in the heavy-duty trucking industry.

Future Regulatory Trends in Heavy-Duty Truck Regulations and Tariffs

The heavy-duty truck industry is on the brink of significant changes influenced by emerging regulatory trends and shifting political landscapes. Several anticipated trends will shape the future of heavy-duty truck regulations, particularly concerning international trade agreements and the impact of future U.S. administrations.

New Tariffs on Imported Trucks and Parts

On October 17, 2025, President Donald Trump signed a proclamation imposing a 25% tariff on imported medium- and heavy-duty trucks and truck parts, effective November 1, 2025. This initiative aims to strengthen domestic manufacturing while addressing national security concerns. A notable impact will be on Mexican exports, which are the largest sources of heavy-duty trucks in the U.S. market. Additionally, a 10% tariff on imported buses was also announced source.

Industry Responses and Market Impact

These tariffs have elicited mixed responses across the industry. Domestic manufacturers like Peterbilt, Kenworth, and Freightliner may find a competitive edge as foreign competition diminishes, particularly against companies affected by supply chain disruptions. However, critics within the American Trucking Associations (ATA) warn that higher acquisition costs could impede recovery efforts within the industry, which is still reeling from the effects of a freight recession source.

Volvo, as a leading global manufacturer, anticipates continued weakness in the North American market, projecting heavy truck delivery estimates to drop due to these tariffs and their resultant economic implications source.

Trade Relations and Global Dynamics

Mexico’s response to these tariffs also raises significant concerns as exported trucks from there consist of a notable percentage of U.S. content, alluding to the complex interdependence structured under the United States-Mexico-Canada Agreement (USMCA). The shift in tariff structures may necessitate manufacturers to evaluate their production strategies and sourcing of components source.

Environmental Regulations and Future Stipulations

In addition to tariffs, the future landscape of heavy-duty truck regulations is likely to increasingly intertwine with environmental considerations. The EPA is poised to enact stringent emissions regulations for heavy-duty vehicles, stretching from 2027 to 2032. This set of regulations aims to reduce greenhouse gas emissions significantly, which will require manufacturers to innovate continuously in green technologies and fuel efficiency source.

Conclusion

As the U.S. moves forward, the intersection of trade policies, international dynamics, and future regulatory changes will likely define the fate of the heavy-duty truck sector. Stakeholders must remain vigilant, adapting to new challenges and opportunities within this complex regulatory environment, especially as future administrations may introduce their policies and trade perspectives.

Logistical Changes for Manufacturers in Response to Tariffs

Manufacturers like RK Logistics and Wabash are poised to make significant adjustments in their logistics and supply chain operations following the implementation of the new 25% tariff on heavy-duty trucks. One of the key strategies is likely to shift sourcing practices to minimize costs. This shift may involve a greater reliance on domestic suppliers to circumvent the tariff implications associated with imported goods, allowing manufacturers to stabilize their expense structures.

Additionally, there is anticipation that distribution strategies will adapt to focus on enhancing efficiency within domestic operations. By streamlining these operations, manufacturers aim to offset the rising costs that the tariff introduces. With an emphasis on local markets, corporations might also invest in developing more localized warehouses and service centers, similar to Wabash’s recent expansion with a new Parts & Service center in Atlanta. These facilities not only help lower distribution costs but also improve customer service by reducing delivery times and ensuring better accessibility to parts and services.

The shift towards domestic production will prompt RK Logistics and Wabash to strengthen collaborations with U.S.-based manufacturers. This could entail strategic alliances that reinforce supply chains, improve cost management, and mitigate risks associated with tariff changes. Consequently, manufacturers might find it essential to reassess their transportation and logistics networks in order to maintain cost-effective delivery solutions in an increasingly competitive environment.

Investing in state-of-the-art logistics technology and analytics will also likely become a priority. By utilizing advanced systems for tracking, routing, and managing inventory, companies like RK Logistics and Wabash can optimize their logistics operations. This not only helps to keep operational costs down but also ensures that service levels remain high, which is critical in maintaining customer satisfaction during a period of considerable financial pressure from new tariffs.

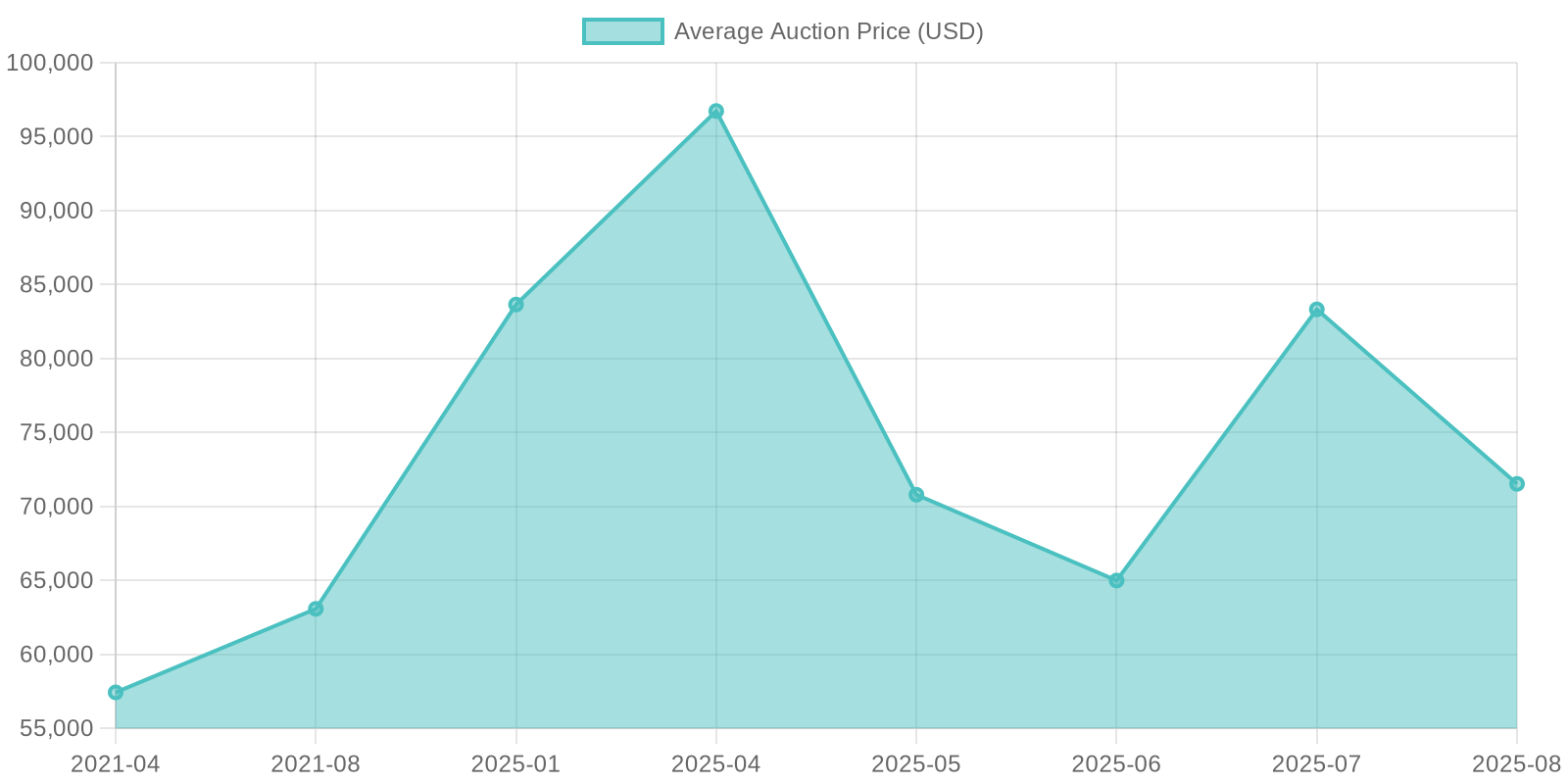

Historical Truck Pricing Trends

This chart compares average auction prices for late-model Class 8 sleeper tractors from 2021 to 2025, illustrating the impact of various factors, including economic conditions and tariffs, on truck pricing.

- 2021 saw record high auction prices due to strong demand and tight supply.

- 2025 reflects a wide range of prices, indicative of seasonal trends and economic influences such as tariffs.

Introduction

The regulation and tariff landscape for heavy-duty trucks is a complex and evolving issue that has significant implications for manufacturers, consumers, and the economy at large. President Trump’s announcement of a 25% tariff on all imported heavy-duty trucks marks a critical juncture in this landscape. This bold move, aimed at nurturing U.S.-based manufacturing, promises to not only reshape the competitive dynamics within the trucking industry but also ripple through the broader economy. With major stakeholders like Peterbilt, Kenworth, and Freightliner potentially facing changing market scenarios, the stakes are high. As truck manufacturers and operators contemplate the costs and benefits of this tariff, its long-term effects on truck prices, availability, and operational costs will likely reverberate beyond the industry confines. This article delves into the significance of these regulations and tariffs, exploring their far-reaching consequences and what they mean for the future of heavy-duty trucking.

Historical Context of Truck Tariffs

The history of tariffs on trucks in the United States provides a significant backdrop to the current regulatory landscape. One pivotal moment came in 1964 with the implementation of the “Chicken Tax.” This 25% tariff was levied on light trucks as retaliation for European tariffs on American poultry. The Chicken Tax had a lasting effect on the automotive industry, allowing American manufacturers like Ford, General Motors, and Chrysler to secure a dominant position in the light truck segment. The tariff led foreign manufacturers, such as Toyota and Nissan, to establish production facilities within the U.S. to bypass the trade barrier. This shift not only stimulated local economies but also reshaped global supply chains and manufacturing strategies, emphasizing the importance of domestic production.

Fast forward to recent history, under President Donald Trump, new tariffs were imposed in October 2025, including a significant 25% tariff on all imported medium- and heavy-duty trucks and associated parts, reflecting national security concerns. This move aimed at bolstering U.S.-based manufacturing but raised immediate concerns regarding potential price hikes for consumers and manufacturers alike. A study indicated that these tariffs could cost U.S. automakers over $108 billion, with the major players in the domestic market facing significant increases in production costs due to tariffs on imported parts.

Comparison of Heavy Truck Manufacturers

| Manufacturer | Market Share (%) | Headquarters | Recent Initiatives |

|---|---|---|---|

| Peterbilt | 19.2 | Denton, Texas | Expansion of electric truck models |

| Kenworth | 17.5 | Kirkland, Washington | Launch of advanced safety features |

| Freightliner | 24.3 | Portland, Oregon | Investment in eco-friendly technologies |

| Mack Trucks | 11.7 | Greensboro, North Carolina | New hybrid truck models |

| International Motors | 12.4 | Lisle, Illinois | Initiative for autonomous driving tech |

| Volvo | 7.5 | Greensboro, North Carolina | Enhanced connectivity features |

| Wabash | 3.3 | Lafayette, Indiana | Development of lightweight materials |

| Fleetco | 1.1 | Various Locations | Fleet modernization programs |

| CS Truck and Trailer | 1.2 | Various Locations | Focus on customer service enhancements |

| RK Logistics | 1.0 | Tempe, Arizona | New logistics facilities opening |

Analysis of Economic Implications of the 25% Tariff on Heavy-Duty Trucks

The recent imposition of a 25% tariff on imported heavy-duty trucks is set to have profound economic implications. This analysis delves into how the tariff impacts manufacturers, suppliers, and consumers, touching on key themes such as pricing, competition, and job creation.

Pricing Impact

The tariff is expected to lead to significant price increases for heavy-duty trucks. According to the American Trucking Associations (ATA), the cost of a new Class 8 truck could rise by approximately $30,000 due to the new tariff. Such an increase compounds existing trends; from 2021 to 2023, the average price of Class 8 tractors surged from about $140,000 to $170,000, reflecting a rise of approximately 21%. Furthermore, estimates from S&P Global Mobility suggest that the net effect on truck prices might reach around 9%, which could significantly reduce demand for new commercial vehicles by as much as 17%.

These price hikes not only affect truck manufacturers but also ripple through industries reliant on such trucks, potentially increasing operational costs and limiting accessibility for smaller businesses that depend on these vehicles.

Competition Changes

The competitive landscape in the heavy-duty truck sector is poised for transformation. U.S.-based manufacturers such as Paccar Inc. may gain a competitive advantage over foreign companies due to the tariff. Following the announcement, stocks for Paccar rose nearly 7%, signaling investor confidence in the company’s enhanced market position. Conversely, companies like Daimler Truck and Traton, which operate extensively outside the U.S., have already started to see declines in their shares, indicating potential difficulties in maintaining their market presence against U.S. competitors.

Supplier Concerns

The tariff also affects suppliers who may have to adjust their sourcing strategies to remain competitive. The added costs associated with importing parts and vehicles could drive manufacturers to prioritize domestic suppliers or those from countries exempt from tariffs, fundamentally altering existing supply chain dynamics.

Job Creation and Labor Market Implications

Proponents of the tariff argue that it could stimulate domestic manufacturing and job creation by making imported trucks more expensive, thereby encouraging increased production within the U.S. This growth could bolster jobs in the automotive sector. However, critics caution against overestimating job growth, warning that higher costs could dampen consumer demand and affect employment in sectors reliant on heavy-duty trucks.

The American Trucking Associations has expressed concerns that the additional expenses — upwards of $35,000 for a new heavy truck — may lead businesses to delay fleet renewals, potentially stunting job growth in logistics and maintenance sectors dependent on service demand.

Conclusion

The economic implications of the 25% tariff on heavy-duty trucks represent a complex interplay among rising prices, evolving competition, and labor market uncertainties. As stakeholders adjust to these changes, the long-term effects on the industry and the broader economy will unfold, shaping the future of heavy-duty trucking in profound ways.

Inbound Links to Statistics Data Sources

-

Impact of Trump’s 25% Tariff on Heavy-Duty Trucks and Pricing Statistics:

-

On October 17, 2025, President Donald Trump announced a 25% tariff on imported medium- and heavy-duty trucks and parts, effective November 1, citing national security concerns. This policy is expected to significantly impact the trucking industry, particularly in terms of vehicle pricing and market dynamics.

source -

Analysts estimate that the average price of a heavy-duty truck could rise by $25,000 to $30,000 due to the tariffs.

source -

The American Trucking Associations projects that the 25% tariff could add as much as $35,000 to the cost of a new heavy truck.

source -

If the tariffs persist through the end of 2025, new commercial vehicle demand in the U.S. could decrease by as much as 17%.

source

-

On October 17, 2025, President Donald Trump announced a 25% tariff on imported medium- and heavy-duty trucks and parts, effective November 1, citing national security concerns. This policy is expected to significantly impact the trucking industry, particularly in terms of vehicle pricing and market dynamics.

-

American Trucking Associations Data on Heavy-Duty Truck Pricing Trends:

-

The ATA and its Technology & Maintenance Council report that combined parts and labor costs remained flat in the first quarter of 2025, following a 1.4% decrease in the previous quarter, reflecting ongoing economic uncertainties.

source -

Heavy-duty repair shops reported up to a 40% increase in counter sales in 2023 compared to 2022, signaling some recovery in demand.

source -

After two years of declines, truck volumes are projected to grow by 1.6% in 2025, with expectations to reach nearly 14 billion tons by 2035.

source -

Estimates from the Clean Freight Coalition indicate that electrifying the U.S. commercial truck fleet would require up to $1 trillion in infrastructure investments.

source

-

The ATA and its Technology & Maintenance Council report that combined parts and labor costs remained flat in the first quarter of 2025, following a 1.4% decrease in the previous quarter, reflecting ongoing economic uncertainties.

These sources provide essential data and analysis on the implications of new tariffs and market dynamics affecting heavy-duty trucks.